Despite what the film ‘There Will Be Blood’ may have led you to believe, there is much more to effective oil production than discovering some ground seepage, digging a hole, and becoming Daniel Day-Lewis. There are several stages of drilling these days, each with its own set of risks, goals, and prices. Before making any financial decisions based on relevant news and results, investors must be aware of these. In this section, we will go through the most common types of wells, detailing what each one strives to achieve and where it falls on the route to production.

Prior to drilling

Before considering where to drill a well, oil and gas firms must conduct a number of key exploratory tasks. First and foremost, geologists identify locations with a high probability of containing hydrocarbons due to factors such as current local production and favorable geological conditions Once a choice is made to access a certain region, the company must get a permit to search for oil and gas. This is normally awarded by a government-controlled licensing authority as part of a licensing cycle.

Following approval, the company will conduct seismic studies to map out geological formations and offer an early idea of the amount of any possible deposit present. The organization will either ‘drill or drop’ its location at this point. If it decides to drill, it will use the information acquired to scout drilling locations before the good phase can begin.

It is important to note that the duration of any of these first stages, like the duration of any of the activities covered in this article, should not be underestimated. When governments, regulatory agencies, and complicated geologies are involved, enterprises always incur the danger of project delays, cost overruns, and – tragically – project cancellation.

Well for exploration

Exploration wells, often known as ‘wildcat wells,’ are the first step of a company’s drilling activities. In terms of failure against success, these are the wells with the biggest risk. While the benefits might be enormous, the number of wildcat wells that lead to commercial discoveries can be as low as one in every fifteen.

Wildcat wells are often drilled to determine whether or not there is any oil or gas available in an untested site. They can, however, be used to extend the boundaries of a known pool. As a result, as speculators seek huge returns on the next big oil hit, these wells frequently draw the most investor interest in the small-cap market.

The wells are not utilized for production and are employed in both new locations and untested sites inside areas with established hydrocarbon output. Instead, they are utilized to create discoveries and expand on previous research in areas like rock and fluid characteristics, initial reservoir pressure, and reservoir productivity. Petroleum find discovered by an exploratory well normally takes five years to begin production.

a good appraisal

Once a discovery has been made, an oil and gas company will typically drill an appraisal well. The wells, which have a higher success rate and are more expensive than exploration wells, are used to calculate the size of an oil-gas field (both physically and in terms of reserves) and its expected production rate. They are also used by a corporation to determine the most efficient means of developing a finding or if drilling at all makes economic sense.

When gambling on drill results, appraisal wells might provide the finest risk/reward ratios.

Well-developed

Once a hydrocarbon deposit has been located, analyzed, and determined to be economically viable, a company will enter the final step the drilling of a development well These wells often have a substantially greater success rate than the previously listed wells. They are, however, incredibly expensive, ranging from $1 million to $9 million per. This is due to the fact that they are larger and deeper than exploration or appraisal wells, as well as having a much longer life cycle and operational length.

Simply, development wells are dug for the purpose of extracting oil or gas. A company will try to maximize the economic output of its wells by using all of the data gathered from prior efforts to drill to depths it believes would be most productive.

Other kinds of wells

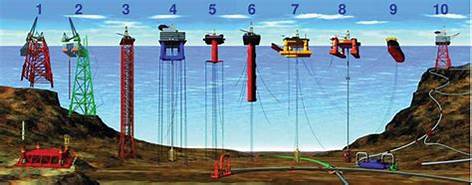

The most generally mentioned types of wells in the industry are exploration, appraisal, and development wells.

However, the unpredictability of oil drilling has led to the development of several additional types of specialty wells. These enable companies to deal with specific geological challenges in their projects as they emerge. Here are a few examples:

When a well has already been drilled or partially drilled, but it is necessary to drill out of one side of the well to a different target, a sidetrack well is employed. There are several reasons for doing so. For example, an irretrievable object such as a fish or a collapsed wellbore may have left a part of the original well useless. Another cause might be that all of the hydrocarbons at the original wellbore have now been exhausted, necessitating the need for a business.

Relief wells are used to stop the flow of oil or gas from a separate, damaged well. Firms will frequently base these wells a distance away from the damaged well before utilizing directional drilling to intersect the damaged well at a significant depth. To stop any undesired flow, a specialized liquid such as heavy drilling mud or cement is poured into the damaged well.

Injection wells are used to inject liquids or gas into porous geologic formations underground. In order to improve oil production, waste disposal, and avoid saltwater intrusion, anything from water to carbon dioxide may be pumped into anything from deep sandstone to shallow soil layers.

Horizontal wells are gaining popularity as an alternative to typical vertical wells. Rather than stopping drilling after the well has reached the required depth, a company drilling a horizontal well will twist the drill bit 90 degrees and continue to drill horizontally along the target horizon for up to 10,000 feet.

Horizontal drilling is frequently paired with hydraulic fracturing, sometimes known as ‘fracking,’ a technique in which large volumes of fracturing fluid are forced into a well at extremely high pressure. This pressurized combination breaks the rock and deepens existing fissures, allowing the oil and gas trapped therein to flow easily to the surface.

The advantages of horizontal drilling in conjunction with hydraulic fracturing are arguably best viewed in comparison to vertical drilling. To begin with, it is critical to recognize that most oil and gas reserves are more

They are more vast in their horizontal dimensions than in their vertical dimensions. As a result, when a vertical well is drilled directly into a 100-foot-thick, hydrocarbon-bearing deposit, any recovery is confined to the oil and gas that flows into that little region of penetration.

A horizontal drill, on the other hand, drills horizontally into the formation from this point, exposing the wellbore to thousands of feet of the additional reservoir rock. In low-permeability locations, this increased exposure can cause a horizontal well’s total recovery rate to be 10 times that of a vertical well. In most circumstances, the higher productivity is sufficient to offset the additional expenditures of digging a horizontal well, which can be up to 300 percent more expensive when used at a larger scale, this principle provides various additional cost benefits. As seen in the picture above, many vertical wells would be necessary to cover the same area of a target horizon as a single horizontal well. Vertical wells would not only be more expensive and harmful to the environment in this case, but they would also be less effective. This is owing to the horizontal well’s ability to add production from the distance between vertical wells while simultaneously enjoying greater levels of pressure due to the existence of only one hole.

Producers in stacked pay zones, like the Permian Basin, can also drill many horizontal wells in one location to target separate formations at different depths. In addition to increasing the resource potential, It enables significant economies of scale since numerous wells from a single pad may target various zones while sharing infrastructure and services. Today, this enables producers to take resources from several geological strata above and below those from which traditional oil has been extracted for decades.

Completing

As can be observed, various wells require different approaches. A successful exploratory well, for example, maybe exhilarating, but numerous obstacles still exist in the way of future production. Similarly, while it is unusual, news of a failed development well is significantly more catastrophic from an economic standpoint than news of a failed exploration well. As a result, it is critical for resource investors, Before turning over or withdrawing their funds, resource investors must understand the relevance and context of every drilling update.