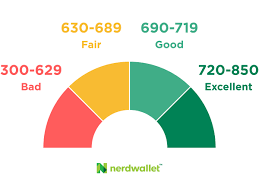

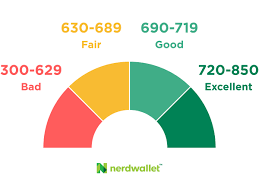

the credit score is important in so many aspects of your financial life. A decent credit score increases your chances of being approved for the best credit cards and loans, and you won’t have to spend an arm and a leg for them.

Even if you don’t intend to take out any loans or credit lines, it has broader implications. For example, in order to rent an apartment, you may need to have a specific credit score. If your credit score isn’t stellar, you may be forced to put down deposits on utility accounts or even be turned down for certain professions.

Even if you’ve had credit troubles in the past, improving your credit score isn’t that tough. All you need is a basic awareness of how credit scores function, the determination to stick to a few excellent financial practices, and some patience.

How are credit scores calculated?

If you have a loan or owe money to a corporation, it is likely that they have reported that information to one or more of the three credit bureaus: Equifax, Experian, and TransUnion. These credit bureaus retain information about your payment patterns on file, such as how much you owe, the type of account you have, and whether you’ve made your payments on time. Your credit report contains this information.

Other organizations, such as FICO (the most popular credit scoring company), can then utilize your credit report to compute your credit score. As a result, your credit report is similar to your primary school teacher’s grade book, and your credit score is similar to your final grade.

When determining your credit score, some aspects of your credit report are more relevant than others, and various models function in different ways. Here are the several criteria that contribute to your FICO® Score to give you an understanding of how it works:

35 percent payment history

The total amount owed: 30%

15 percent have a long credit history.

The credit mix is 10%.

10% for new credit

How to Boost Your Credit Score

As you can see above, certain factors have a greater impact on your credit score than others. Some problems also take longer to repair than others, which is helpful to know when determining how to improve your credit score.

For example, if you want to apply for a new credit card next month, you should concentrate on things you can do to enhance your credit score quickly.

Examine your credit report and contest any mistakes.

Given the importance of your credit report, you’d think it’d be accurate. Surprisingly, inaccuracies on your credit report are rather prevalent, and they can have a negative impact on your credit score.

The official government website, AnnualCreditReport.com, allows you to check your credit report for free once per year with each of the three credit agencies. Examine your credit report with a fine-toothed comb to ensure that everything on it makes sense. If you notice something suspicious, you can challenge it with the credit bureau.

When it’s corrected, you could see an instant improvement in your score.

Pay all bills on promptly, including utilities and cell phone bills.

Did you know that the most important element influencing your credit score is payment history? By paying your payments on time, you can prevent having late fees reported to credit bureaus. If you have difficulties remembering, you may set up reminders or even set up autopay for your accounts.

Even one late payment can damage your credit score, and it will remain on your credit record for seven years (although thankfully its negative impact will fade over time). It isn’t much you can do once a late payment appears on your credit record other than wait for it to disappear.

As a result, the single most essential thing you can do to boost your credit score is to pay your payments on time.

Debt reduction

The amount of debt you owe, especially how much credit card debt you owe compared to your credit limit, is the second most important factor determining your credit score. This is referred to as your credit usage ratio.

You may improve your credit score by keeping this number as low as possible, preferably as near to zero as feasible. In reality, the best suggestion is to pay off your credit card in full each month if at all possible. You’ll also avoid having to pay interest this way. That can be a tall order, especially if you’re like millions of other Americans who carry a credit card load month after month.

Even if you can’t pay off your account totally, there are certain steps you can do. Here are some tried-and-true ways for improving this component of your credit score:

Request an increase in your credit limit from your credit card company: Your credit usage ratio will decrease even if you continue to maintain the same debt as long as you do not spend your new expanded line of credit.

Make numerous payments throughout the month: There is no rule that states you must just make one payment every month. Paying down your debt as many times as you like during the month, Indeed, it is possible to keep it at a more tolerable level.

Maintain a credit usage level of less than 30%; zero is preferable. However, if you can’t handle that right now, many financial gurus recommend aiming for 30 percent or less in the interim.

Request fresh credit. sparingly

When you apply for new credit, such as a credit card or a loan, it will be documented on your credit report as a hard credit inquiry, whether or not you are accepted. These credit queries aren’t as long-lasting (just two years, but they’ll only be incorporated into your score for a year), but they can damage your credit score.

Credit inquiries normally do not have a significant impact on your credit score, but if you don’t have much information on your credit report already, the drop might be greater. That’s why it’s better to put off applying for credit until you’re confident you’ll be accepted. If you need a loan, don’t let this deter you from searching around for the best rates. In other circumstances, such as when shopping for a car loan, if you finish your rate shopping within a 14- to 45-day period, all of your loan applications will be processed as a single inquiry.

Consider obtaining a secured credit card.

If your credit is bad or you don’t have a long credit history, getting accepted for a loan might be difficult, You must have a credit card or a loan to establish credit, but you must also have a solid credit score to be authorized for said loans and credit cards.

Applying for a secured credit card may be a simpler solution. Secured credit cards need an initial deposit that is typically equivalent to the card’s credit limit. Because of the upfront payment, these cards are frequently accessible with considerably looser credit standards because it reduces the lender’s risk. They’re also frequently more expensive and offer fewer benefits than a conventional credit card, so it’s a smart idea to move up to a standard credit card as soon as you’re able, call your credit card provider and check if you may move to a better credit card instead of canceling it completely. In that manner, you may keep your present credit line active, extending the life of your credit.

Speak with your collectors

Late payments and account delinquencies are major setbacks that are difficult to overcome. If you find yourself in this situation, it’s worth contacting your debt collectors to see if you can work out a payment plan to keep a bad record off your credit report.

The laws governing debt collection might be a bit perplexing. If you’re feeling overwhelmed, one smart alternative is to contact a competent credit counselor through the National Foundation for Credit Counseling.

Keep a variety of credit accounts.

Finally, the sorts of credit that you hold might have an impact on your credit score. If you have many types of accounts, such as a personal loan and a credit card, or an auto loan and a mortgage, you demonstrate to potential creditors that you can manage multiple types of debt.

This isn’t a significant influence on your credit score, and we never encourage taking on extra debt to improve your credit score. However, if you are looking to finance a crucial purchase, you may want to explore creating another sort of account to assist improve your credit score.

If you have a trusted friend or family member, one useful approach is to request that you be placed as an authorized user on their credit card account. This offers you the advantage of having their whole account history shown on your credit report as well, just as if you’d had that account the entire time.

This is obviously not something to be taken lightly. You’ll need to trust your friend or family member to manage the account properly so that you don’t face any fines as a result of their mistakes. They’ll also need to trust you if they’re going to provide you with a secondary credit card, which they don’t have to do.

Be persistent and diligent.

Some parts of your credit score take time to develop and necessitate your undivided attention. For example, if you fail to make a loan payment for a single month and your credit score suffers as a result, there isn’t much you can do but wait.

After all, your credit score is intended to demonstrate to lenders how well you handle money in the long run. Yes, there are several easy treatments that can significantly improve your credit score. But, when it comes down to it, the greatest thing you can do is never miss a payment and handle your debt wisely.

What effects do adjustments have on your credit score?

Working to improve your credit score may often be a frustrating exercise since the improvements you make may not have the desired effect. This is because the method used to compute your credit score considers a wide range of criteria, each of which may have a varied impact depending on your position.

In general, you may expect to improve your credit score by paying off debt. However, in other situations, such as when you pay off an installment loan, you may see a short-term drop in your credit score.

The best advice is to keep to the main guidelines given here because they will most likely aid you no matter what adjustments you make in the future.

How long does it take to reestablish your credit?

Everybody’s credit status is unique. Options accessible to one individual may not be available to another. However, in general, the following activities can help you boost your credit in the short term:

Paying all of your bills on time

Changing any inaccurate information on your credit report

Paying off your debts (especially credit card balances)

Keeping previous credit cards active to increase your credit history (unless you don’t use them and they have yearly fees)

Being added as an authorized user to the account of a responsible friend or family member

It isn’t much you can do to enhance your credit score if you have any credit inquiries, late payments, delinquencies, bankruptcies, or other bad marks on it. The majority of these things will remain on your credit record for a full seven years. Chapter 13 bankruptcies are also listed on your credit report for seven years, although Chapter 7 bankruptcies are removed after ten years.

The negative impact of these items on your credit score will lessen over time before they are removed entirely. However, if you have a bankruptcy or foreclosure on your credit record, it may be tough to qualify for a mortgage.

Nonetheless, concentrating on excellent financial habits, such as paying off your credit card amounts in full each month, will go a long way toward improving your credit score. With time, the rest of those bad items will be removed from your credit report, and you’ll be able to rebuild your credit.

Keep an eye on your credit score and report while you attempt to improve it. You can keep track of your progress this way, and it will help motivate you as you see the fruits of your labor.