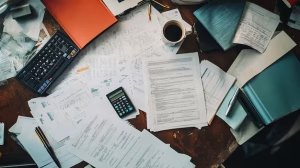

Disorganized finance refers to financial systems or personal financial management that lack structure, planning, and efficiency. It can lead to instability, inefficiency, and even economic collapse in both individual and institutional contexts.

Key Aspects of Disorganized Finance

- Lack of Budgeting – Without a clear budget, spending becomes unpredictable, leading to financial instability.

- Poor Record-Keeping – Failure to track income, expenses, and debts results in confusion and mismanagement.

- Unstructured Debt Management – High-interest debts accumulate when there’s no strategy for repayment.

- Inconsistent Cash Flow – Irregular income or spending patterns create financial uncertainty.

- Absence of Emergency Funds – Financial crises become harder to manage without savings for unexpected expenses.

- Impulsive Spending – Unplanned purchases drain resources and hinder long-term financial goals.

- Failure to Invest Wisely – Lack of structured investment planning leads to missed opportunities for wealth growth.

Disorganized Finance in Economic Systems

In broader financial systems, disorganization can lead to economic instability. Studies on financial collapse in transition economies highlight how disorganization contributed to economic downturns in the former Soviet Union. Factors such as inter-firm arrears, lack of credit enforcement, and barter systems played a role in financial instability.

How to Overcome Financial Disorganization

✅ Create a Budget – Track income and expenses to maintain financial stability.

✅ Organize Financial Records – Use apps or spreadsheets to monitor transactions.

✅ Develop a Debt Repayment Plan – Prioritize high-interest debts to reduce financial strain.

✅ Build an Emergency Fund – Set aside savings for unexpected expenses.

✅ Adopt Smart Spending Habits – Avoid impulsive purchases and focus on financial goals.

✅ Invest Strategically – Diversify investments to ensure long-term financial security.