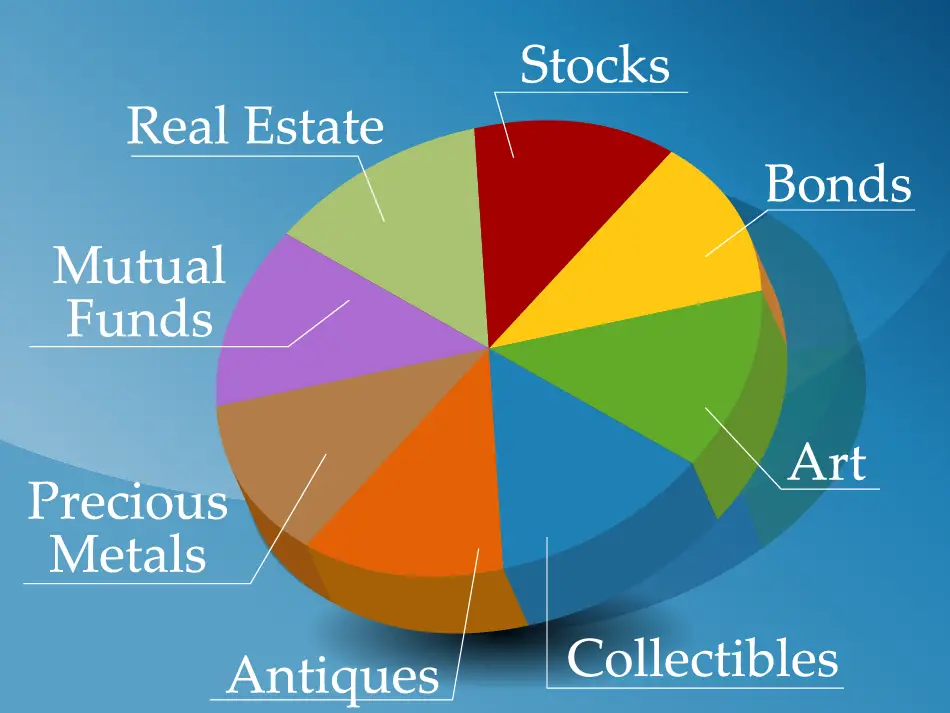

Building wealth requires strategic investment choices across various asset classes. Here are some investment vehicles to consider:

Traditional Investment Vehicles

- Stocks: Buying shares in companies allows you to benefit from capital appreciation and dividends.

- Bonds: Fixed-income securities that provide stable returns with lower risk compared to stocks.

- Mutual Funds: Professionally managed portfolios that pool money from investors.

- Exchange-Traded Funds (ETFs): Diversified funds that trade like stocks on the market.

- Real Estate: Investing in properties for rental income or capital appreciation.

Alternative Investment Vehicles

- Private Equity: Investing in private companies for long-term growth.

- Venture Capital: Funding startups with high growth potential.

- Hedge Funds: Actively managed funds utilizing diverse investment strategies.

- Commodities: Gold, silver, oil, and agricultural products provide portfolio diversification.

- Cryptocurrency: Digital assets offering speculative growth but high volatility.

Passive Income Investments

- Dividend Stocks: Companies distributing profits to shareholders regularly.

- REITs (Real Estate Investment Trusts): Property portfolios generating income for investors.

- Peer-to-Peer Lending: Loaning money to individuals or businesses for interest payments.

- Rental Properties: Generating cash flow through tenants.

- Automated Investment Platforms: Robo-advisors manage portfolios based on algorithms.

Tax-Advantaged Investment Vehicles

- Retirement Accounts (401(k), IRA, Roth IRA): Growing wealth with tax benefits.

- Index Funds: Low-cost, diversified funds tracking market performance.

- Annuities: Insurance products providing steady income after retirement.

What trends are influencing these investment vehicles today?

Investment vehicles constantly evolve due to economic shifts, technological advancements, and investor preferences. Here are some key trends shaping the landscape today:

1. Rise of Alternative Investments

- Impact Investing: Investors increasingly prioritize social and environmental impact alongside financial returns.

- Private Equity & Venture Capital: High-growth startups and private companies continue to attract capital.

- Cryptocurrency & Blockchain: Digital assets remain volatile but are gaining mainstream acceptance.

2. Technological Advancements

- AI & Automation: Robo-advisors and AI-driven investment strategies are reshaping portfolio management.

- Tokenization of Assets: Real estate, stocks, and commodities are being digitized for fractional ownership.

- Fintech Growth: Digital platforms are making investing more accessible to retail investors.

3. Sustainable & ESG Investing

- Green Bonds & Renewable Energy: Investors are shifting toward sustainable assets.

- ESG (Environmental, Social, Governance) Criteria: Companies with strong ESG practices are attracting more capital.

4. Market Volatility & Economic Uncertainty

- Inflation & Interest Rates: Central bank policies are influencing investment decisions.

- Geopolitical Risks: Global conflicts and trade policies are affecting asset prices.

- Diversification Strategies: Investors are seeking safer, diversified portfolios to hedge against uncertainty.

5. Real Estate & Private Markets

- REITs & Rental Properties: Real estate remains a strong investment vehicle despite market fluctuations.

- Private Debt & Secondary Markets: Investors are exploring non-traditional lending and resale opportunities