TERM LIFE INSURANCE OR LIFE ASSURANCE

is a contract between an insurance policyholder and an insurer or assurer in which the insurer agrees to pay an amount of money to a selected beneficiary upon the insured person’s death (often the policyholder). Other occurrences, such as terminal sickness or severe illness, may also trigger payment, depending on the contract. The policyholder usually pays a premium, which can be paid on a monthly basis or in one lump payment. Other expenditures, such as funeral costs, may be covered by the benefits.

Life insurance plans are legal contracts, and the terms of each contract specify the insured events’ restrictions. Exclusions in insurance contracts often restrict the insurer’s obligation; prominent examples include claims involving suicide, fraud, war, riot, and civil unrest. When an event is not clearly defined, such as when the insured deliberately accepted risk by consenting to an experimental medical treatment or taking medicine that resulted in harm or death, difficulties may develop..

The death benefit will be given to the beneficiary if the life insured dies within the term. Term insurance is often the cheapest option to buy a significant death benefit on a coverage amount per premium dollar basis for a fixed period of time.

Permanent life insurance, such as whole life, universal life, and variable universal life, contrasts with term life insurance. Unless the policy is allowed to lapse, which guarantees coverage at set premiums throughout the life of the covered individual. Term insurance is not often utilized for estate planning or charity giving plans, but rather for a single person’s income replacement requirements. Term insurance works similarly to most other forms of insurance in that it pays claims against the insured provided premiums are paid on time and the contract has not expired, but it does not pay out premium money if no claims are submitted. In the case of an accident, vehicle insurance will pay claims against the insured, while a homeowner policy will pay claims against the house if it is damaged or destroyed as a result of a fire, for example. It’s unclear whether or not these events will take place. The insurance provider will not reimburse the full amount if the policyholder cancels coverage because he or she has sold the insured automobile or home.

Usage

Because term life insurance is a pure death benefit, its principal purpose is to pay the insured’s or his or her beneficiaries’ financial obligations. Consumer debt, dependent care, university education for dependents, burial fees, and mortgages are examples of such duties. Even if the applicant has a greater risk, such as a daily smoker, term life insurance may be preferred over permanent life insurance because term insurance is typically significantly less expensive[1] (depending on the length of the term). For example, an individual could pick a policy whose term finishes at his or her retirement age on the assumption that by the time he or she retires, he or she would have acquired a substantial sum of money.

The term is renewed every year.

One-year term life insurance is the most basic type of term life insurance. If the insured died within the one-year period, the insurance company would pay the death benefit, but if the insured died one day after the one-year term ended, no benefit would be given. The premium is then calculated depending on the likelihood of the insured dies within that year.

Because the chances of dying in the next year are slim for everyone who qualifies for coverage, purchasing only one year of coverage is uncommon.

The requirement of proof of insurability is one of the key barriers to renewal for several of these plans. The insured, for example, may suffer a grave disease during the time, yet not die until after the term has ended Because of the terminal disease, the purchaser would most likely be uninsurable at the end of the original term, preventing them from renewing or purchasing a new policy.

Guaranteed insurability is a provision of certain policies that allows the insured to renew without having to show proof of insurability.

Annual renewable term insurance is a type of term insurance that is regularly acquired (ART). The premium is paid for one year of coverage, but the policy is assured to be renewed every year for a certain number of years. This time span might range from 10 to 30 years, or even up to 95 years. . As the insured grows older, the premiums rise with each renewal term, eventually making the policy financially unviable because the rates would soon exceed the cost of permanent coverage. The price is slightly greater than for a single year of coverage, but the likelihood of receiving the benefit is substantially higher.

Contracting parties

The policy owner is responsible for paying payments on the policy, whereas the insured is the person who would get the death benefit if they die. It’s possible that the owner and insured are the same individuals. For example, if Joe purchases a life insurance policy for himself, he is both the owner and the insured. If Jane, Joe’s wife, buys a life insurance policy on him, she is the owner and he is the insured. The guarantor is the policy owner, and they will be the ones to pay for it. The insured is a party to the contract, but not a party to the contract.

A diagram of a life insurance policy

When the insured individual dies, the insurance proceeds are distributed to the beneficiary. The beneficiary is chosen by the policy’s owner, but the beneficiary is not a party to the contract. Unless the insurance provides an irreversible beneficiary designation, the owner can modify the beneficiary. Any beneficiary changes, policy assignments, or cash value borrowing would require the original beneficiary’s consent if the policy includes an irrevocable beneficiary.

Insurance firms have attempted to limit policy sales to people having an insurable interest in the CQV in circumstances when the policy owner is not the insured (also known as the celui qui vit or CQV). Close family members and business partners are frequently determined to have an insurable interest in life insurance plans. In most cases, the insurable interest criterion indicates that if the CQV dies, the purchaser will incur some sort of loss. This rule stops persons from profiting from the acquisition of purely speculative insurance on people who are expected to die in the near future. The possibility of a purchaser murdering the CQV for insurance proceeds would be high if there was no insurable interest requirement. In at least one example, an insurance firm was found accountable in court for contributing to the wrongful killing of the victim by selling a policy to a purchaser with no insurable interest (who then killed the CQV for the money).

Conditions of the contract

Special exclusions may apply, like suicide provisions, which make the insurance invalid if the insured commits suicide within a certain amount of time (usually two years after the purchase date; some states provide a statutory one-year suicide clause). Any misrepresentations made by the insured on the application might result in the policy being canceled. Most states in the United States, for example, have a maximum contestability term, which is usually no more than two years. The insurer will only have a legal right to oppose the claim on the basis of deception and request more information if the insured dies within this time frame.

Although the actual death benefit might be larger or smaller than the face amount, the face amount is the initial amount that the insurance will pay upon the insured’s death or when the policy matures. When the insured dies or reaches a certain age, the policy matures (such as 100 years old).

Costs, insurability, and underwriting are all factors to consider.

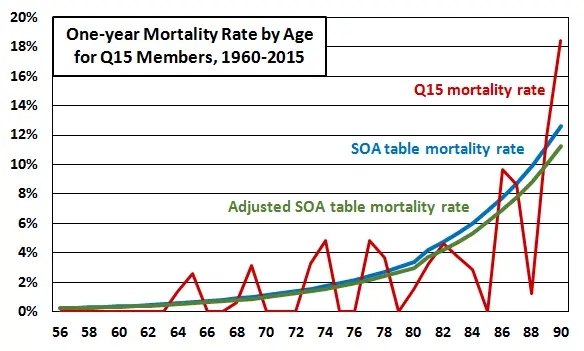

The insurance firm sets policy rates (premiums) high enough to pay claims, cover administrative costs, and make a profit. Actuaries develop mortality tables to assess the cost of insurance. Mortality tables are tables based on statistics that illustrate the projected yearly mortality rates of persons of various ages. Because people are more likely to die as they become older, insurance firms use mortality rates to measure risk and adjust premiums appropriately. Estimates like this can be crucial in tax law.

The mortality figures serve as a starting point for determining insurance costs, but the applicant’s health and family history are also considered (except in the case of Group policies). Underwriting is the phrase for the study and evaluation that follows. Questions on health and lifestyle are posed, with some replies indicating that more research is needed.

Underwriters may take into account the following factors:

Personal medical history;

Family medical history;

Driving record;

Height and weight matrix (BMI) (Body Mass Index).

Applicants will be assigned to one of many health rating classes based on the aforementioned and other characteristics, which will affect the premium paid in return for insurance with that specific insurer.

The Medical Information Bureau (MIB), which is a clearinghouse of information on people who have filed for life insurance with participating businesses in the previous seven years, is supported by life insurance companies in the United States. The insurer frequently requests the applicant’s authorization to get information from their physicians as part of the application process.

Automated Life Underwriting is a technological solution that aims to decrease the amount of labor effort, time, and/or data required to underwrite a life insurance application by doing all or some of the screening duties usually performed by underwriters.

These technologies enable point-of-sale distribution and, depending on the quantity of insurance, can reduce the time it takes to issue a policy from weeks to months to hours or minutes. The mortality rate of underinsured people grows substantially faster than that of the overall population. After ten years, that 25-year-old non-smoking male’s death rate is 0.66/1000/year. As a result, a life insurance company would have to collect around $50 per year from each member in a group of 1,000 25-year-old males with a $100,000 policy, all of the average health, to pay the comparatively few predicted claims. (0.35 to 0.66 predicted deaths per year x $100,000 per death benefit = $35 per policy) When determining premiums, other expenditures including administrative and sales expenses must be taken into account. For a $100,000 coverage, 10-year insurance for a 25-year-old non-smoking guy with a favorable medical history might cost as little as $90 per year.

Premiums make up the majority of an insurance company’s revenue, but profits from investing premiums are a significant source of profit for most life insurance firms. This does not apply to group insurance coverage.

With the exception of the Civil Rights Act, compliance requirements, life insurance businesses in the United States are never legally obligated to provide coverage to everyone. Insurability is determined solely by insurance companies, and certain persons are declared uninsurable. The policy can be denied or rated (with the premium amount increasing to compensate for the increased risk), and the premium amount will be proportional to the face value of the policy.

Many businesses divide applicants into four groups. Preferred best, preferred, standard, and tobacco are the four classifications. The preferred option is Only the healthiest members of the overall population are eligible. This might indicate that the potential insured has no negative medical history, is not on any medications, and has no family history of early-onset cancer, diabetes, or other illnesses. The potential insured is preferred if he or she is presently taking medicine and has a family history of certain diseases. The majority of people fall under this group.

Because of the greater mortality rate, those who use tobacco usually have to pay higher rates. According to recent[when?] US mortality estimates, 0.35 out of 1,000 nonsmoking males aged 25 will die in the first year of a policy. For every 10 years of age gained, death nearly doubles, therefore non-smoking men’s mortality rate in the first year is roughly 2.5%.

At the age of 65, there are 1,000 persons. In comparison, male mortality rates in the United States are 1.3 per 1,000 at age 25 and 19.3 at age 65. (without regard to health or smoking status).

Benefits after death

Before paying a claim, the insurer requires satisfactory evidence of death from the insured. If the insured’s death appears to be suspicious and the policy amount is significant, the insurer may examine the circumstances surrounding the death before choosing whether or not to pay the claim.

Payment from the insurance can be in the form of a lump payment or an annuity, which is paid in monthly installments over a certain length of time or for the rest of the beneficiary’s life.

The terms assurance and insurance are interchangeable.

The phrases “insurance” and “assurance” are used in a variety of ways and are occasionally perplexed In general, “insurance” refers to giving coverage for an event that could occur (fire, theft, flood, etc.) in jurisdictions where both terms are used, whereas “assurance” refers to providing coverage for an event that is certain to occur. Both types of coverage are referred to as “insurance” in the United States for the sake of simplicity among firms marketing both products. [requires citation] According to certain definitions, “insurance” refers to coverage that calculates benefits based on real losses, whereas “assurance” refers to coverage that provides predetermined benefits regardless of losses.

Life insurance is classified into two categories: temporary and permanent, as well as subcategories like term, universal, whole life, and endowment.

Term insurance

Term assurance is a type of life insurance that covers you for a set period of time. The policy does not build up any monetary value over time. Term insurance is substantially less expensive than a comparable permanent coverage, but the cost will rise as you become older. Policyholders can put money aside to cover higher term premiums or lower their insurance needs (by paying off debts or saving to provide for survivor needs).

Because what is protected is the principal and interest outstanding on a mortgage that is continually being decreased by mortgage payments, mortgage life insurance normally has a flat premium amount for a dropping policy face value. The face amount of the policy is always the amount of outstanding principal and interest that will be paid if the applicant defaults or dies.

.

Life insurance for a group

Term insurance for a group of individuals, generally workers of a firm, members of a union or organization, or members of a pension or superannuation fund, is known as group life insurance (also known as wholesale life insurance or institutional life insurance). Individual proof of insurability is usually not taken into account when it comes to underwriting. Rather, the underwriter looks at the group’s size, turnover, and financial soundness. Contrary to popular belief, contract terms will aim to exclude the potential of adverse selection. Exiting a group life insurance policy typically permits members to keep their coverage by purchasing individual coverage. The underwriting is done for the entire group rather than for individuals.

Life insurance that lasts a lifetime

Permanent life insurance is a type of life insurance that covers the insured for the rest of his or her life.

A cash value is built up in a permanent insurance policy until it matures. The cash value can be accessed by withdrawing funds, borrowing funds, or surrendering the insurance and obtaining the surrender value.

Whole life, universal life, and endowment are the three most common forms of permanent insurance.

Throughout your entire existence

Whole life insurance is the focus of this essay.

For a predetermined payment, whole life insurance offers coverage for the rest of one’s life.

Life insurance that is available to everyone

Universal life insurance (ULl) is a relatively new insurance product that aims to combine permanent insurance coverage with greater premium payment flexibility as well as the possibility for higher cash value growth. There are numerous varieties of universal life insurance plans, including interest-sensitive (also known as “traditional fixed universal life”) and non-interest-sensitive (also known as “traditional fixed universal life”).

It also includes equity-indexed universal life insurance with a guaranteed death payout.

Cash values are available with universal life insurance plans. Premiums that have been paid to raise their cash worth; administrative and other expenditures decrease it.

The perceived shortcomings of whole life insurance, notably that premiums and death benefits are set, are addressed with universal life insurance. Both the premiums and the death benefit are adjustable with universal life. Universal life policies, with the exception of guaranteed-death-benefit universal life plans, sacrifice greater flexibility for fewer guarantees.

The term “flexible death benefit” refers to the policyholder’s ability to reduce the death benefit. The policy owner can also enhance the death benefit, although this normally necessitates fresh underwriting. The flexibility to select between Option A and Option B death benefits is another element of flexible death benefits to alter such alternatives over the course of the insured’s life Option A is known as a “level death benefit” since death payments stay constant throughout the insured’s life and premiums are cheaper than plans with Option B death benefits, which pay the policy’s cash value—that is, the face amount plus earnings/interest. If the monetary value increases over time, so do the death benefits. The death benefit decreases as the cash value decreases. Premiums for option B insurance are often higher than for option A policies.

Endowments

The endowment policy is the main topic of this essay.

The endowment policy is a type of life insurance contract that pays out a lump amount after a certain period of time (called “maturity”) or upon death. Ten, fifteen, or twenty years of age are typical maturities. In the event of a critical illness, certain plans pay money.

Traditional profit-sharing or unit-linked policies are common (including those with unitized with-profits funds).

Endowments can be cashed in (or surrendered) early, and the holder receives the surrender value, which is decided by the insurance company based on the length of the policy and the amount put into it.

Death by mistake

Accidental death insurance is a sort of restricted life insurance that pays out if the policyholder dies in an accident. “Accidents” might range from minor scrapes to major disasters, although they often exclude deaths caused by non-accident-related health issues or suicide. These insurance are less expensive than others since they only cover accidents.

If the insured person is killed in a car accident. This was previously known as double indemnity insurance. Triple indemnity coverage may be offered in particular instances.

Pre-need and senior goods

In recent years, insurance firms have developed policies for specialized groups, most notably seniors in an aging society. These are usually whole life insurance plans with a low to moderate face value, allowing older persons to acquire cheap coverage later in life. This is also known as final expenditure insurance and often has death rewards ranging from $2,000 to $40,000. [requires citation] One of the reasons for their appeal is because they simply demand simple “yes” or “no” replies, whereas other plans require a medical checkup. The range of premiums, like with other insurance kinds, can be rather extensive.

Exam and no-exam rules might differ significantly in terms of health questions. Individuals with specific conditions may be eligible for one form of coverage but not the other. [requires citation] Because seniors are frequently unaware of the policy restrictions, policyholders may think, for example, that their plans would endure forever. noting that some policies’ premiums grow at set periods, like every five years. [requires citation]

Pre-need life insurance plans are whole life insurance policies with a low premium payment that are typically obtained by elderly people, however, they are accessible to anybody. This sort of insurance is meant to cover particular funeral expenditures specified by the applicant in a contract with a funeral home. The death benefit of the policy is calculated based on the funeral costs. It normally develops when interest is credited at the time of prearrangement. The funeral home often promises that the profits will pay the cost of the funeral regardless of when the policy owner dies in return for the policy owner’s designation. As specified in the contract, excess funds may be distributed to the insured’s estate, a selected beneficiary, or the funeral home. Premiums are normally paid in one lump sum at the time of prearrangement, however, some businesses allow premiums to be paid over a period of up to ten years.

Products that are similar

Riders are additions to an insurance policy that are made at the time it is issued. These riders alter the base policy to include a benefit that the policyholder desires.

Accidental death is a common rider. A premium waiver, which waives future premiums if the insured becomes incapacitated, is another typical rider.

Joint life insurance is a type of term or permanent life insurance that covers two or more people and pays out if one of them dies.

Unit-linked insurance plans are a type of insurance that is based on the

Unit-linked insurance plan is the main article.

Unit-linked insurance plans are a type of insurance that combines mutual funds and term insurance into a single package. The investor does not share in the plan’s earnings per se but instead receives returns depending on the funds he or she chooses.

Policies that benefit non-profit organizations

With-profits policy is the main topic of this essay.

Some plans provide the policyholder with a share of the insurance company’s earnings; these are known as profit-sharing policies.

Other rules, known as non-profit policies, provide employees no entitlement to a portion of the company’s earnings. To accomplish capital growth, with-profit policies are employed as a type of collective investment program. Other plans provide a guaranteed return that is not based on the company’s underlying investment performance; these are known as without-profit insurance, which is a misnomer.